Standout Advantages: In accordance with Upstart's website, likely borrowers can receive a lending determination just by publishing an application — no money documentation expected. However, they need to nonetheless move a hard inquiry so that you can acquire final approval.

Retroactive interest: Desire is often charged from the acquisition day In the event the harmony isn’t compensated off in ninety days, which makes it Substantially more expensive.

This commission could affect how and exactly where specific solutions seem on This web site (like, such as, the purchase through which they appear). Study more about Find on CNBC, and Click the link to read our entire advertiser disclosure.

We employed the next weightings to calculate a rating for the ideal personal loan for personal debt consolidation:

LightStream features small-fascination loans with versatile conditions for individuals with superior credit score or greater. This lender delivers individual loans for almost every single goal aside from greater education and tiny corporations.

When you've got important merchandise you now not need to have or can give you a services by way of freelance get the job done or gig Careers, you could raise money without taking on financial debt.

Some lenders may possibly even prequalify you with only a tender pull in your credit score, so there’s no influence on your credit rating score. You may as well determine the interest amount and create repayment phrases online.

The amount of you select to borrow is partly up to you to. You need to request by yourself the amount money you'll be able to comfortably pay for to borrow. Make certain the every month payments are cost-effective and which you could repay the funding promptly and in whole.

Making use of for just a loan has never been simpler! With our streamlined 1-Moment Brief Sort, we’ve simplified the procedure to get you one particular move nearer to the money goals.

When CNBC Find earns a Fee from affiliate companions on numerous gives and more info back links, we make all our articles devoid of input from our industrial group or any outside 3rd get-togethers, and we delight ourselves on our journalistic benchmarks and ethics.

Most lenders will approve a cash-out refinance home finance loan to get a borrower that has a optimum credit card debt-to-money ratio of 45%. You could possibly discover one particular prepared to settle for the next DTI, while, particularly when you've got important cash reserves or are implementing for your govt-backed loan.

Who's this for? If you'd like to refinance a significant-value house, Chase approves loans for approximately $nine.five million. That is greater than double the cap most lenders put on jumbo home loans.

We also thought of CNBC Pick viewers data when offered, for instance common demographics and engagement with our information and resources.

Residence equity sharing may possibly appeal to homeowners that are ineligible for other available choices thanks to terrible credit score or possibly a significant credit card debt-to-profits ratio.

Mr. T Then & Now!

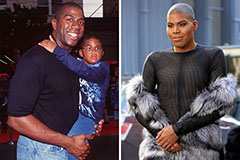

Mr. T Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!